Before GLP-1 drugs became a wildly popular pharmacologic way to treat obesity, bariatric surgery was a top option for those seeking a medical intervention for losing weight. While this procedure is effective for weight loss, it turns out that changing the structure of the gut can lead to a debilitating disorder in some patients. Amylyx Pharmaceuticals, months removed from a clinical trial failure that shattered its prospects in neurodegeneration, is now planting a flag in metabolic disease with the acquisition of a Phase 3-ready drug for this rare disorder with no FDA-approved therapies.

The drug comes from Eiger BioPharmaceuticals, which last month sold off its assets in a bankruptcy auction. Amylyx’s $35.1 million bid was the winner for the drug, avexitide. The transaction, disclosed by the companies in late June, closed on Tuesday. In a Wednesday conference call, Amylyx executives framed the deal as a new therapeutic area for the company, but one that also aligns with its focus on therapies for disorders that have high unmet medical need.

Cambridge, Massachusetts-based Amylyx is finding its way after voluntarily removing from the market Relyvrio, the amyotrophic lateral sclerosis (ALS) drug that was its only FDA-approved product. Relyvrio had won approval based on Phase 2 data. In March, highly anticipated results of a post-marketing Phase 3 study showed the therapy was no better than a placebo. Amylyx was not obligated to withdraw the product, but did so anyway. However, the company has not completely abandoned the drug. Under its former code name of AMX0035, the therapy is in mid-stage clinical development for Wolfram syndrome, a different inherited neurodegenerative disorder that also has metabolic effects on patients.

“This acquisition builds on our areas of expertise in the endocrine space gained through our Wolfram program and is quite transformational for Amylyx, expanding our pipeline outside of neurodegenerative disease with an asset that received FDA’s breakthrough therapy designation,” co-CEO Josh Cohen said.

Avexitide is a peptide that targets the GLP-1 receptor. Many people are aware of GLP-1 drugs for their applications in type 2 diabetes and weight loss. These medications are agonists that activate the GLP-1 receptor to spark metabolic effects, such as appetite suppression. Avexitide takes the opposite approach, blocking the target receptor.

Eiger had advanced avexitide through Phase 2 testing in two rare metabolic conditions in which excessively high levels of insulin lead to dangerously low blood sugar. Amylyx now plans to advance avexitide to Phase 3 testing in one of them: post-bariatric hypoglycemia (PBH), which can develop in the years following a gastric bypass procedure or surgery to reduce the size of the stomach.

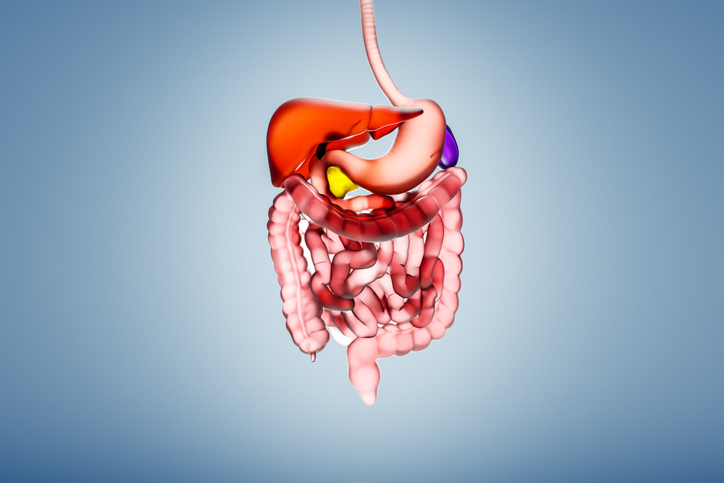

After a meal, it’s normal for the intestines to release GLP-1, which in turn stimulates secretion of the blood sugar-regulating hormone insulin. But in PBH, GLP-1 levels are excessively high. Blood sugar levels can fall so low that patients experience seizures, cognitive dysfunction, even death. By blocking GLP-1 receptors, avexitide is intended to reduce insulin secretion, and in turn, stabilize blood glucose levels. While GLP-1 agonism is clearly tied to weight loss in drugs such as Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, blocking the target receptor is not believed to lead to weight gain. Cohen said Eiger’s PBH studies showed no increase in weight.

“This is a condition where there is super physiologic levels of GLP-1 due to the changed anatomy of the gut,” he said. “Our goal here is not to do something very unnatural, but rather to kind of bring things back to balance.”

Demand for GLP-1 drugs show no sign of slowing, but Amylyx executives don’t see the weight loss market denting demand for bariatric surgery. About 2 million people in the U.S have had bariatric surgery in the past 10 years, and this procedure is still expected to remain a treatment option, especially for those with high body mass indexes, Cohen said. While there are drugs used off label to manage low blood glucose, clinicians and PBH patients told Amylyx that the effect of these therapies is modest. Chief Medical Officer Camille Bedrosian said PBH progresses over time and patients eventually reach a point where they are unable to work or be left alone out of fear that a hypoglycemia event could lead to seizures. Amylyx estimates that 160,000 U.S. patients who have had bariatric surgeries need a therapy to manage their PBH.

Results from Eiger’s placebo-controlled Phase 2 studies show avexitide decreased post-meal insulin levels and was well tolerated by patients. Eiger initiated a Phase 3 clinical trial for the drug but paused that work last year due to lack of funding. The company had licensed avexitide from the University of Pennsylvania and the Children’s Hospital of Philadelphia in 2019, paying $1 million up front. More cash is tied to milestone payments and royalties upon commercialization, according to Eiger regulatory filings. Amylyx has taken over the license agreement, which requires the company to pay a 3% royalty on future sales of an approved product, Chief Financial Officer Jim Frates said.

Amylyx’s new asset puts it at the front of the pack of a small group of companies pursuing PBH. Italy-based Recordati has reached Phase 2 testing with a Novartis-partnered peptide drug called pasireoitide. Vogenx is taking a different approach with mizagliflozin, a small molecule intended to reduce glucose absorption as well as the secretion of insulin and gastric inhibitory peptide (GIP) hormones. In late June, the Durham, North Carolina-based biotech reported its drug met the main and secondary goals of a placebo-controlled Phase 2 study enrolling PBH patients. Meanwhile, Carmel, Indiana-based MBX Biosciences aims to treat PBH with an engineered peptide codenamed MBX-1416. This program is in early clinical development.

Amylyx co-CEO Justin Klee said there are likely additional therapeutics applications for GLP-1 antagonists. While PBH and hyperinsulinism is Amylyx’s main focus for its new asset, Klee said the drug’s mechanism could lead to sturdies in other indications as well.

Eiger’s PBH studies of avexitide evaluated both twice daily and once daily dosing. Amylyx said its Phase 3 program will evaluate a 90 mg dose of the injectable drug administered once daily. In an investor presentation, the company said it expects to start the study in the first quarter of 2025 and report data in 2026. If all goes well and the drug passes regulatory muster, Amylyx projects a potential 2027 product launch.

Photo: OsakaWayne Studios, via Getty Images