In the U.S., health insurance premiums are tax deductible–if paid through out of pocket expenses–but out-of-pocket expenses are not. However, there are exceptions to this rule. These include two often-used tax-favored accounts:

- Flexible savings accounts (FSA). These accounts allow employees to set aside a portion of their pretax income to cover qualified medical expenses; however, if the employee does not use these funds by the end of the year, they are forfeited.

- Health savings accounts (HSA). HSAs also allow employees to save pretax income to cover qualified medical expenses, but–unlike FSAs–HSA balances roll over from year to year. While anyone with a qualified plan can enroll in an FSA, only employees who enroll in a high-deductible health plan (HDHP) are allowed to contribute to an HSA.

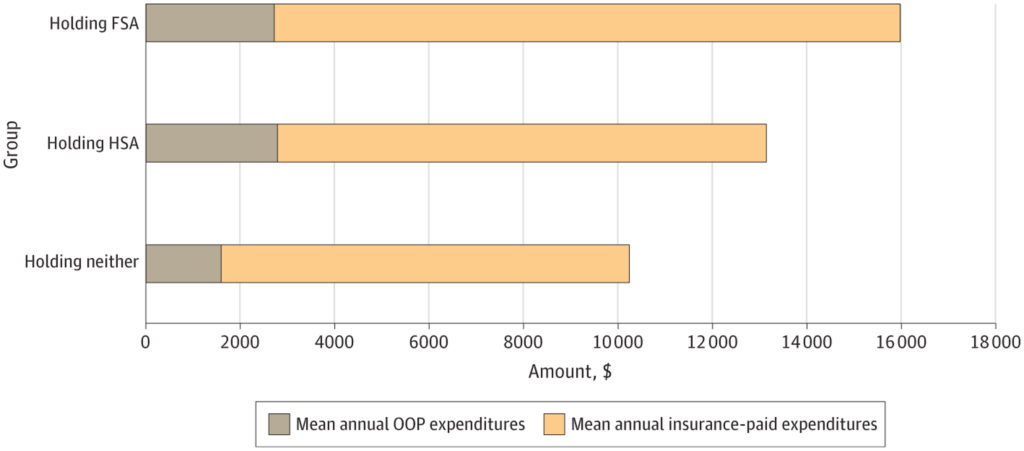

How does having an FSA or HSA impact health care expenditures. A paper by Ding and Glied (2024) use data on health care expenditures for working age adults from the 2011-2019 Medical Expenditure Panel Survey (MEPS) to find the answer. Their study found that:

…families with FSAs spent a mean of 20% or $2033 (95% CI, $789-$3276) more on health care annually than non–account holding families, largely due to increased insurer-paid expenses. Families with HSAs spent a mean of 44% or $697 (95% CI, $521-$873) more on out-of-pocket expenditures and had insignificantly higher insurance-paid expenditures than families without accounts, resulting in overall expenditures comparable to those of non–account holders. The additional tax expenditures associated with FSAs were a mean of $1306 (95% CI, $536-$2076) annually per family.

You can read the full paper here.