How can a biotech startup raise more than $1 billion over four plus years and say almost nothing publicly along the way? For Treeline Biosciences, the silence was strategic. Out of view of prying eyes, Treeline has quietly built a pipeline whose most advanced programs are cancer drugs addressing known targets but in new or potentially better ways. With a fresh infusion of $200 million added to its funding haul and programs in early clinical development, Treeline is now pulling back the curtain on some of its work.

The new financing is an extension of Treeline’s Series A round of funding, the Watertown, Massachusetts-based company said Wednesday. It includes a broad syndicate of well-known investors that bought into Treeline’s vision of reimagining the way to finance and build a different kind of drug discovery company.

Emerging biotechs are typically funded milestone to milestone, Treeline co-founder and CEO Josh Bilenker said in a Wednesday blog post. Taking that approach would lead Treeline to make choices to reach the next milestone and keep focus on a lead program. Instead, Treeline asked investors to fund “repeated invention” that supports multiple but complementary programs. This approach gave Treeline flexibility to fully vet programs before progressing to the clinic and also to drop struggling ones.

“We’ve abandoned programs because we couldn’t find good chemistry hits, because we had negative or mixed data in efficacy models, because there weren’t good efficacy models, because we didn’t achieve adequate [absorption, distribution, metabolism, and excretion], because we had lingering concerns around safety, and because other companies got there first with great data,” Bilenker wrote. “Having the luxury of moving on from programs is probably the greatest gift our funding mandate has given us.”

Treeline on Wednesday disclosed three cancer programs, two internally discovered and one that was in-licensed. Internally discovered TLN-121 is a degrader of BCL6, a naturally occurring protein that certain lymphoma cells use to silence genes that would block their growth and survival. A Phase 1 study is enrolling patients with B-cell and T-cell lymphomas.

The second disclosed internal Treeline program is TLN-372, an inhibitor of KRAS, a difficult-to-drug mutation that drives cancer growth. Amgen’s Lumakras and Bristol Myers Squibb’s Krazati are both FDA-approved small molecule inhibitors of a specific KRAS mutation called KRAS G12C. TLN-372 is a pan-KRAS small molecule inhibitor that blocks multiple KRAS variants. Treeline is conducting a Phase 1 study enrolling patients with KRAS-altered solid tumors. The startup has competition in this space. Other companies developing pan-KRAS inhibitors include Revolution Medicines, Astellas Pharma, Amgen, and BridgeBio Oncology Therapeutics.

The third disclosed Treeline program is TLN-254, which was licensed from Jiansu Hengrui Pharmaceuticals. Hengrui had advanced this drug as far as Phase 2 testing in refractory lymphoma. The small molecule inhibits EZH2, a protein that is overexpressed or mutated in cancer. Treeline is testing TLN-254 in a Phase 1 study enrolling patients with peripheral and cutaneous T-cell lymphomas. A fourth program for an undisclosed target is on track for an investigational new drug application filing in early 2026.

Treeline’s approach to drug discovery brings laboratory and computational approaches together under the same roof. While other startups claim the same, Bilenker said Treeline is not focused on a particular therapeutic area or a platform technology. Instead, Treeline pursues carefully selected targets with the best available technology, he said.

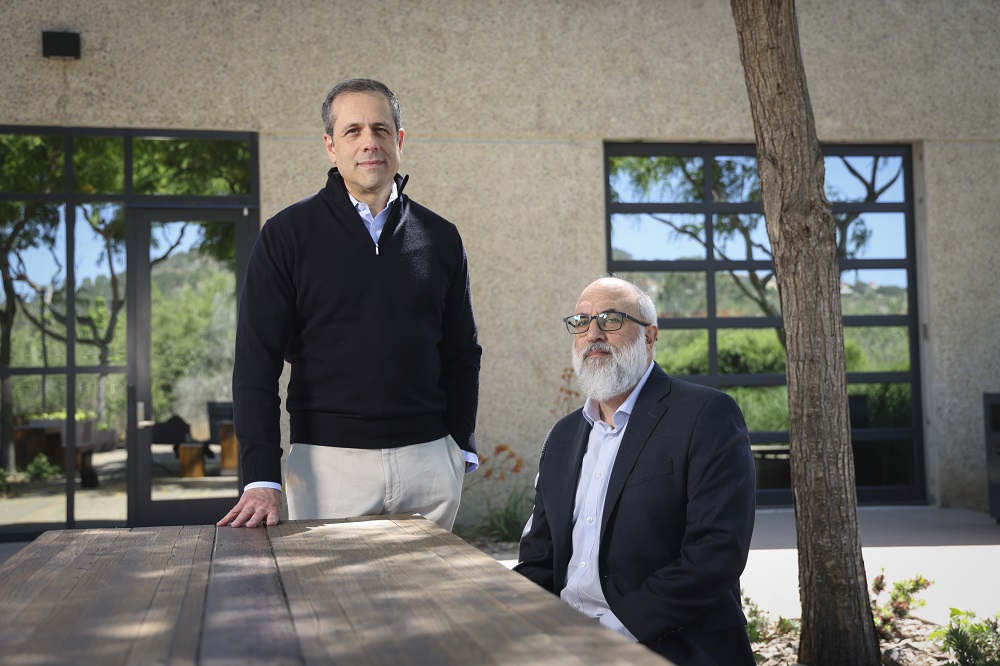

Bilenker’s experience includes founding Loxo Oncology, which Eli Lilly acquired in 2019 for $8 billion. Treeline’s other co-founder is Chief Science Officer Jeff Engelman, the former global head of oncology at the Novartis Institutes for BioMedical Research. While the oncology experience of both is reflected in the Treeline pipeline, the startup says on its website that cancer research informs its work in other therapeutic areas. The company pursues these areas, such as autoimmune and neurological disease, “when we believe we have a unique advantage.”

Treeline formed in early 2021, based in Watertown, according to Massachusetts corporation records. The startup revealed a little about itself in 2022 when it disclosed the addition of KKR to its investor syndicate with “a significant capital commitment.” At the time, a securities filing showed the company had raised more than $261 million.

To date, Treeline said it has raised about $1.1 billion total. The startup’s investors include AI Life Sciences, an affiliate of Access Industries; Arch Venture Partners; OrbiMed; GV; KKR; accounts advised by T. Rowe Price Associates; Ajax Health/Zeus; Casdin Capital; Fidelity Management & Research Company; Aisling Capital; Rock Springs Capital; and Exor.

Photo by Treeline Biosciences