Guaranty Trust Holding Company (GTCO) has announced an impressive payout of N14.72 billion in interim dividends to its shareholders as of HY’2024. This significant financial move underscores GTCO’s commitment to rewarding its investors and reflects its strong financial performance in the first half of the year.

In this article, we will delve into the details of GTCO paying shareholders N14.72 billion interim dividends, exploring the financial implications, the company’s performance metrics, and what this means for current and potential investors.

Stay informed on how GTCO continues to create value and foster investor confidence with this substantial interim dividend payout.

GTCO Paying Shareholders N14.72 Billion Interim Dividends

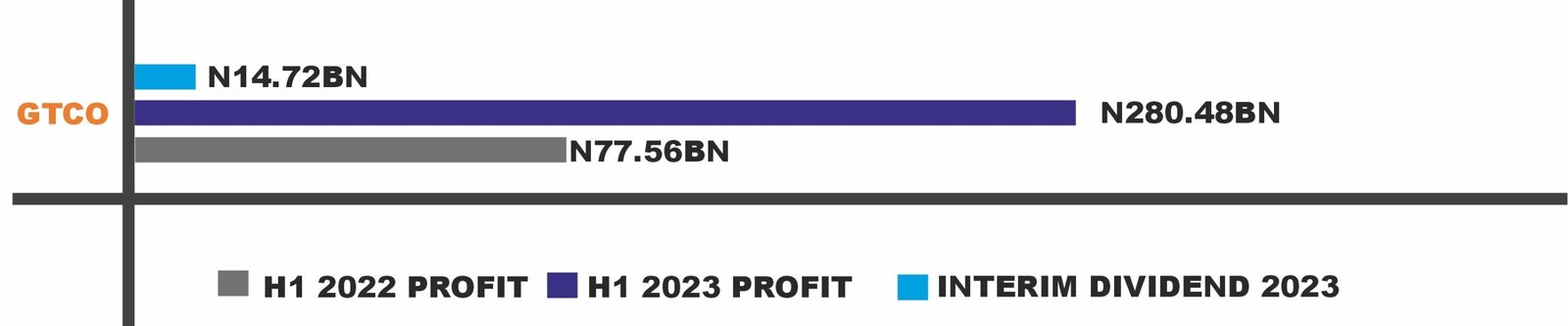

Guaranty Trust Holding Company (GTCO) Plc declared an interim dividend of NGN 0.50 per ordinary share for the first half of 2024, totaling NGN 14.72 billion. This follows a total dividend payout of NGN 94.18 billion for the fiscal year ended December 31, 2023.

In the previous year, The Board of Directors of the Holding company had proposed the payment of an interim dividend in the sum of 50 Kobo (NGN 0.5) per ordinary share on the issued capital of 29,431,179,224 which was payable to shareholders on the register of shareholding at the closure date.

The interim dividend, subject to the deduction of appropriate withholding tax, was paid to shareholders whose names appeared in the Register of Members as of September 14, 2023, for Ordinary Shareholders and on September 5, 2023, for holders of GTCO’s Global Depository Receipts (GDR).

The Board previously approved a final dividend of NGN 2.70 per share for FY2023, distributed in April 2024. To facilitate efficient future dividend payments, the company had encouraged electronic dividend (e-dividend) registration for direct deposit into shareholder bank accounts.

The dividends were paid electronically to Ordinary Shareholders whose names appeared on the Register of Members as of September 14, 2023, and had completed the e-dividend registration, hence mandating the Registrar to pay their dividends directly into their Bank accounts.

The company advises shareholders who are yet to complete the e-dividend registration to do so by simply downloading the registrar’s E-Dividend Mandate Form, which is available on the registrar’s website and also on GTCO’s official website.

Shareholders with dividend warrants and share certificates that have remained unclaimed or are yet to be presented for payment or returned for validation are also advised to complete the e-dividend registration or contact the registrar.

Information to Note

GTCO’s strong financial performance justifies their dividends. Recent reports indicate significant growth in both profit before tax and gross earnings compared to the prior year.

Nairametrics reported that Guaranty Trust Holdings Plc reported a profit before tax of N327.4 billion, representing an increase of 217.1% over N103.2 billion recorded in June 2022. It was also recently reported that GTCO recorded gross earnings of N1.187 trillion, representing a 120.03% increase from the N539.235 billion reported the year 2023.

Notably, the value of gross earnings has shifted, with foreign exchange revaluation gains assuming a more prominent role alongside traditional interest income.

The foreign exchange (FX) revaluation gains of about N449.347 billion contributed 37.24% to the total gross earnings, a remarkable change from the previous year, where interest income recorded was 60.34% and foreign exchange revaluation gains contributed a mere 10.74% to the gross earnings.

GTCO intends to seek shareholder approval for a potential capital raise of up to USD 750 million. This aligns with industry trends as banks seek to bolster capital adequacy ratios in response to evolving regulatory requirements by the Central Bank of Nigeria (CBN).

The Takeaway

In conclusion, GTCO paying shareholders N14.72 billion in interim dividends as of HY’2024 marks a noteworthy achievement for the company and its investors. This substantial payout is a testament to GTCO’s robust financial health and its unwavering commitment to delivering value to its shareholders.

As the financial landscape continues to evolve, GTCO’s strategic decisions and strong performance metrics position it as a leading player in the industry. Investors can take confidence in GTCO’s ability to generate substantial returns, making it a compelling choice for those looking to invest in a stable and profitable financial institution.

Stay tuned for more updates and insights on GTCO’s financial strategies and market performance.